There are two methods for creating a supplier invoice on Magnetic.

METHOD 1: Create a Supplier Invoice (SI) directly from a Purchase Order (PO)

Follow these steps:

- Click Finance.

- Click on Purchase Orders.

- Find the PO you want to use to create an SI from. (You may want to use the search filters).

- Hover over the Action (3 dots) icons on the right-hand side of the PO. (If you are using list view)

- Select "Add Supplier Invoice".

- A new Supplier Invoice screen will open where you can fill in all the details for the SI.

- Add the relevant information. (All information marked with *must be filled in)

- Contact: Contact at the company the SI is addressed to.

- Company: Company the SI is for.

- Job: The job the SI is associated with. Link this SI to a particular job by adding the relevant job name in here.

- Owner: Person in charge of the SI.

- Title: Supplier Invoice title.

- Tag: A comma-seperated list of tags used to segment your database.

- Issue dates: Date the SI is issued.

- Delivery date: Date goods will be shipped / service provided.

- PO Number: Purchase order number supplied by company.

- Status: Select the workflow stage the SI is in from the dropdown menu. E.g. Issued, Draft.

- Terms of payment: Select the payment term from the dropdown menu. (You can create your own payment term in your company settings under the Finance section).

- Description: Add any extra information you think is important in this text box.

- Item types:

- Select the relevant item type from the dropdown menu. You can create your own list of item types. Alternatively, select the "New item" option from the dropdown menu and create a new item type.

- Section Headings: If you would like to split your SI into sections, choose Section Heading and name it. When printing your SI you will see the line items split and a total per section is automatically added.

- Mouse over a line item to display icons to change order, add new or delete line items.

TIP: To quickly duplicate an item type, hit the copy icon as highlighted below:

- Quantity: A number of hours for that particular item type to be charged for.

- Cost: Basic cost per line item without markup added.

- Mark-up: Percentage added onto Cost. (Note: For externally sourced products/services, set the markup you are adding in before selling).

- Ext. Cost: The product of quantity x cost that the client will be charged. This amount does not include the margin.

- Margin: Profit value that is added onto the external cost amount.

- Line Total: The total of the external cost plus the profit margin.

- Tax type: Select one of the following options on the dropdown menu:

- No Tax: Items which are not taxed.

- Taxable: Items which follow standard taxable rules.

- Zero Rated: Items that are zero-rated for tax purposes.

- Exempt: Item types which ca not be charged VAT.

- Details: This text box is useful if you want to add additional information about the item type being added.

- Add a discount percentage or change the tax percentage if you wish.

- Ensure all the info is correct.

- Save the details.

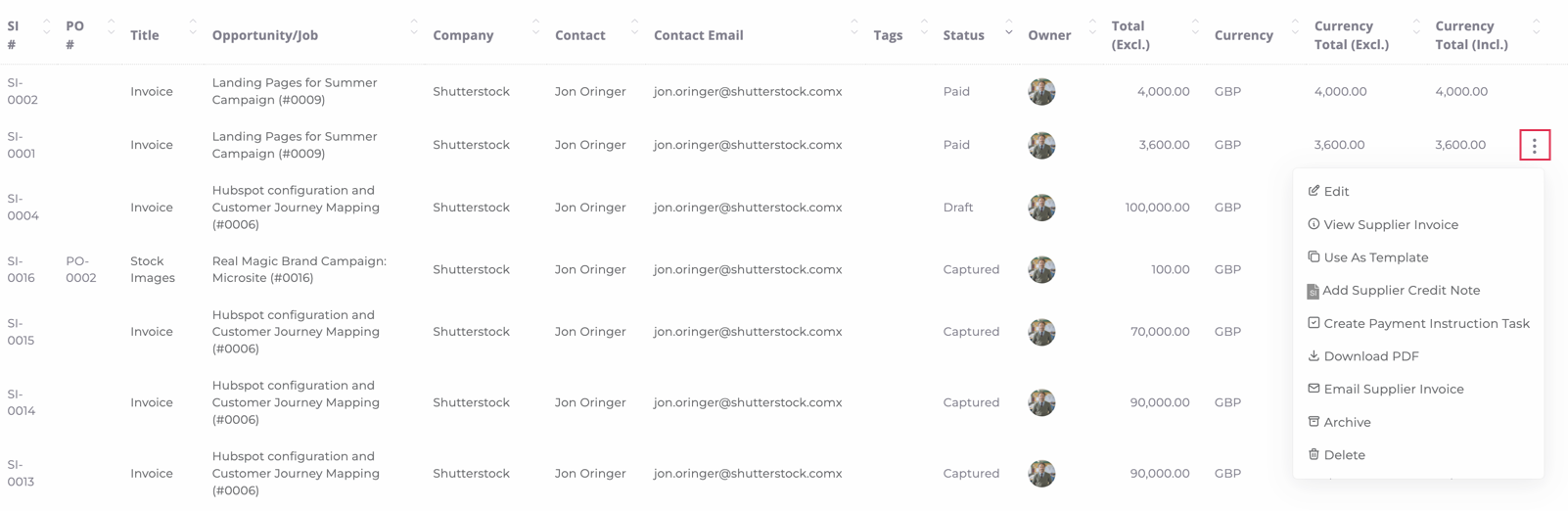

- Download or email the SI to the client by clicking on the Actions(3 dots) icon and selecting the applicable option

See the screenshot below:

METHOD 2: Create a Supplier Invoice

Follow these steps:

3. Click New Supplier Invoice.

4. Add the relevant information. (All information marked with * must be filled in).

5. Ensure all the info is correct. You can also add, remove or move item types by hovering over a line item.

6. Save the details.

7. Download the SI or email the SI to the supplier by clicking on the Actions (3 dots) icon and selecting the applicable option.

See the screenshots below:

Additional Actions available on Supplier Invoices:

Was this article helpful?

That’s Great!

Thank you for your feedback

Sorry! We couldn't be helpful

Thank you for your feedback

Feedback sent

We appreciate your effort and will try to fix the article